For intangible assets, companies use the asset’s useful life to divide its cost over time, while for loans, they use to number of periods for payments. Adjustment entries can also impact a business’s profitability by affecting the amount of revenue and expenses that are recorded in a particular accounting period. For example, if an adjustment entry is made to increase revenue, this will increase the business’s profitability for that period. Conversely, if an adjustment entry is made to increase expenses, this will decrease the business’s profitability for that period.

Accounting for Intangible Assets: A Complete Guide on Amortization and Useful Life

Adjustment entries are not necessary under the cash basis of accounting, as all transactions are recorded when payment is made or received. Adjustment entries are an essential aspect of accounting that ensures financial statements are accurate and follow accounting principles. These entries are made at the end of an accounting period to adjust accounts and reflect any changes that have occurred during the period. However, you amortize intangible assets and depreciate tangible assets. Labeling amortization as the depreciation of intangible assets is incorrect.

What is a Sales Journal? Example, Journal Entries, and Explained

Ultimately, amortization is a useful accounting tool that enables businesses to record the cost of an intangible asset accurately and spread it out over its useful life. Accurately recording the amortization expense is crucial for maintaining accurate financial records and ensuring compliance with accounting standards. Here are some best practices to follow when recording amortization expense.

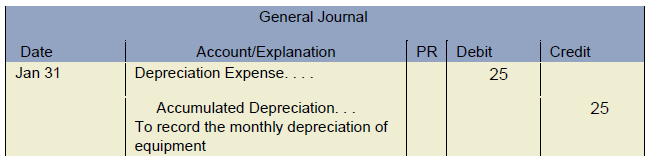

Journal Entry for Accumulated Amortization

- For loans, it helps companies reduce the loan amount with each payment.

- Accounting software can be used to simplify the process of recording adjustment entries.

- This means that it offsets the value of the intangible asset account on the balance sheet.

Deferred revenue is revenue that has been received but not yet earned. To record deferred revenue, an adjusting entry is made to decrease the liability account and increase the corresponding revenue account. Accrued expenses are expenses that have been incurred but not yet paid. To record accrued expenses, an adjusting entry is made to increase the expense account and increase the corresponding liability account. In the income statement, adjustment entries are used to update the values of revenue and expenses. For example, if a company has recognized revenue that has not yet been earned, an adjustment entry is made to remove this revenue from the income statement.

Amortization expense journal entry

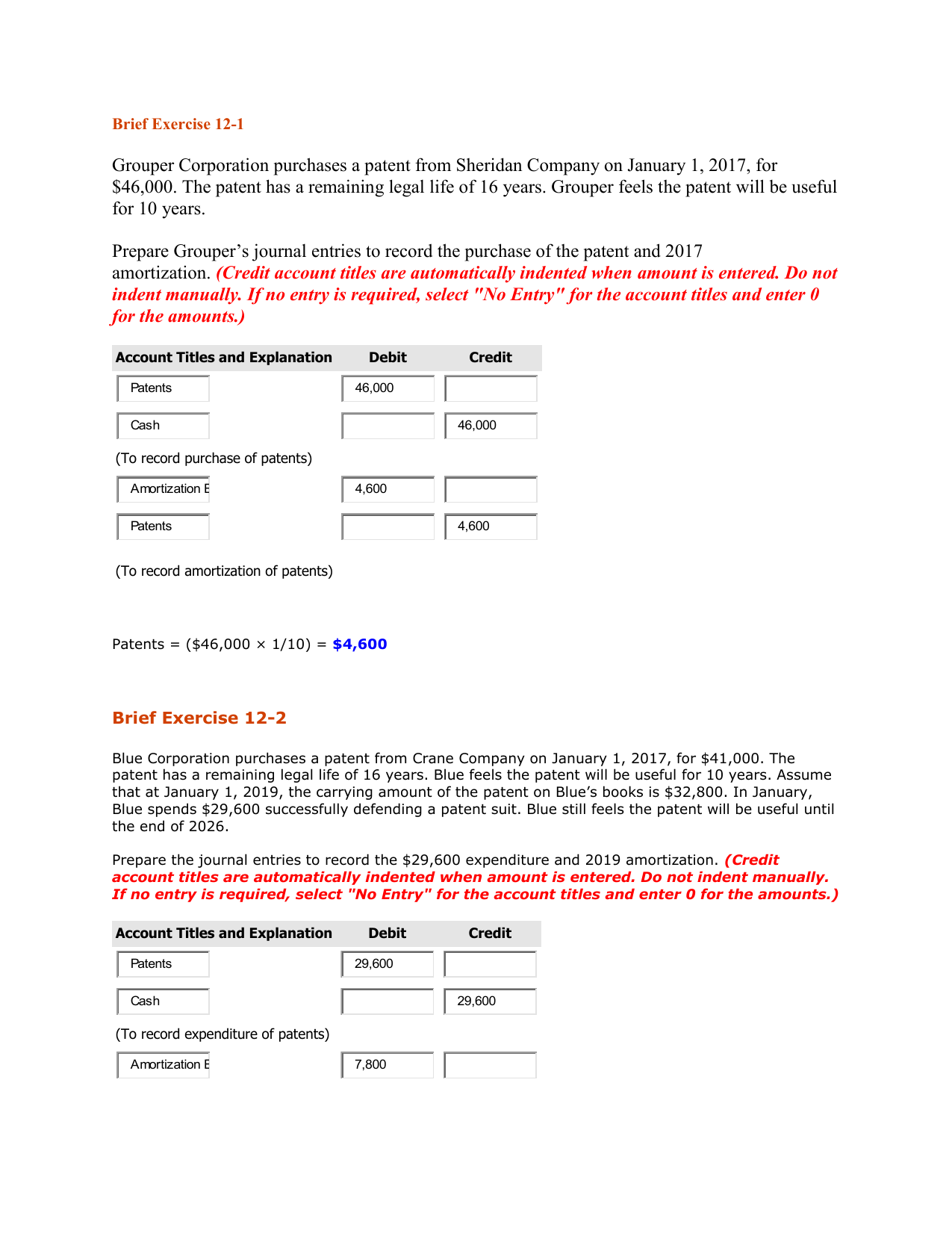

Amortization expense is a crucial concept in accounting that pertains to the gradual allocation of costs over time. It primarily applies to intangible assets and long-term liabilities, such as patents, copyrights, goodwill, or loans. Adjustment entries are an important part of the accounting process that ensures financial statements are accurate and reflect the true financial position of a company. These entries are made at the end of an accounting period to update accounts that were not properly recorded during the period.

Understanding amortization is important for accountants and consumers alike. The calculation for amortization expense typically involves dividing the initial which journal entry records the amortization of an expense cost or carrying value of the asset by its estimated useful life. This determines how much should be recognized as an expense in each reporting period.

So to find an amortization expense, simply divide the asset’s value by its lifespan. Before learning how to account for intangible assets, you need to understand what intangible assets are. Straight-line amortization is a simple way of managing debt and ensures a company makes regular payments, making it easier to budget and plan for the repayment of the loan. It is often used to manage large loans, such as mortgages, that need to be paid off over a long period of time. Amortization is the process of allocating the cost of an intangible asset over a period of time. It is a systematic process of reducing the value of an intangible asset with periodic charges to income.

The goodwill impairment test is an annual test performed to weed out worthless goodwill. During the loan period, only a small portion of the principal sum is amortized. So, at the end of the loan period, the final, huge balloon payment is made. This method is usually used when a business plans to recognize an expense early on to lower profitability and, in turn, defer taxes. Another common circumstance is when the asset is utilized faster in the initial years of its useful life. This method, also known as the reducing balance method, applies an amortization rate on the remaining book value to calculate the declining value of expenses.

This can happen when estimates are not updated or when they are based on incorrect assumptions. To avoid this mistake, it is important to review and update estimates regularly. One of the most common mistakes is making incorrect accounting entries.