This guide offers an in-depth exploration of the chart of accounts, providing definitions, an example, and a downloadable template to enhance your financial organization and reporting. The chart of accounts is a list of every account in the general ledger of an accounting system. Unlike a trial balance that only lists accounts that are active or have balances at the end of the period, the chart lists all of the accounts in the system. It doesn’t include any other information about each account like balances, debits, and credits like a trial balance does. You’ll notice that each account in the chart of accounts for Doris Orthodontics also has a five-digit reference number preceding it.

How HighRadius Can Help You Accelerate Your Business Growth ?

Separating expenditures, revenue, assets, and liabilities helps to achieve this and ensures that financial statements are in compliance with reporting standards. A well-organized and descriptive COA can assist bookkeepers, accountants, and financialmanagement of all types to be confident in their business decisions relying on accurate,timely, and relevant information. It also providesexternal parties with a snapshot view of an organization’s fiscal health for prudentinvestment, purchase, or approval of credit. An important purpose of a COA is to segregate expenditures, revenue, assets and liabilities so viewers can quickly get a sense of a company’s financial health. A well-designed COA not only meets the information needs of management, it also helps a business to comply with financial reporting standards. A chart of accounts records and categorizes all transactions, making sure that every dollar spent or earned is tracked accurately.

What comprises primary financial

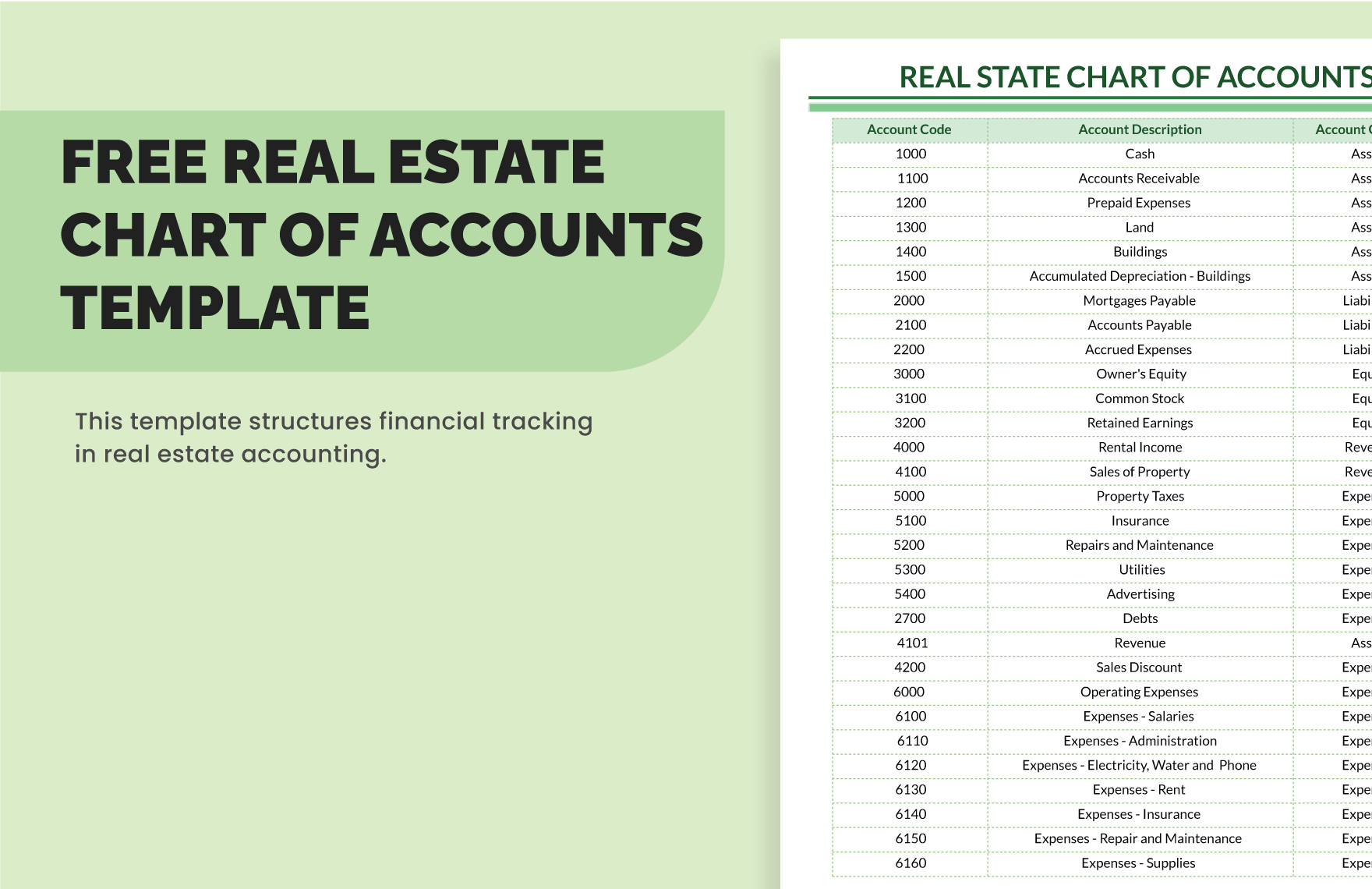

Your COA will most often be referred to when recording transactions in your general ledger. Traditionally, each account in the COA is numbered, and accountants can quickly identify its type by the first digit. For example, asset accounts for larger businesses are generally numbered 1000 to 1999 (or 100 to 199), and liabilities are generally numbered 2000 to 2999 (or 200 to 299). Small businesses with fewer than 250 accounts might have a different numbering system. The role of equity differs in the COA based on whether your business is set up as a sole proprietorship, LLC, or corporation. This would include Owner’s Equity or Shareholder’s Equity, depending on your business’s structure.

- In the European Union, most countries codify a national GAAP (consistent with the EU accounting directives) and also require IFRS (as outlined by the IAS regulation) for public companies.

- To make it easy for readers to locate specific accounts or to know what they’re looking at instantly, each COA typically contains identification codes, names, and brief descriptions for accounts.

- Within the categories of operating revenues and operating expenses, for instance, accounts might be further organized by business function or by company divisions.

- Here’s a deeper look at the mechanics of a COA and how it supports everyday accounting practices.

- There is a generally accepted numbering structure for the accounts, so everyone’s accounts appear in roughly the same order and with similar numbering.

- Each category will include specific accounts for your business, like a business vehicle that you own would be recorded as an asset account.

Is there a single COA format?

The information is usually arranged in categories that match those on the balance sheet and income statement. A COA is a listing of all the financial accounts in a company’s general ledger (GL). They are grouped into categories that correspond to the structure of an organization’s financial statements. These GL accounts are used to categorize every financial transaction a company makes and offer even an outsider a holistic view of an organization’s assets, expenditures, and income, all in a single place.

Tax COA

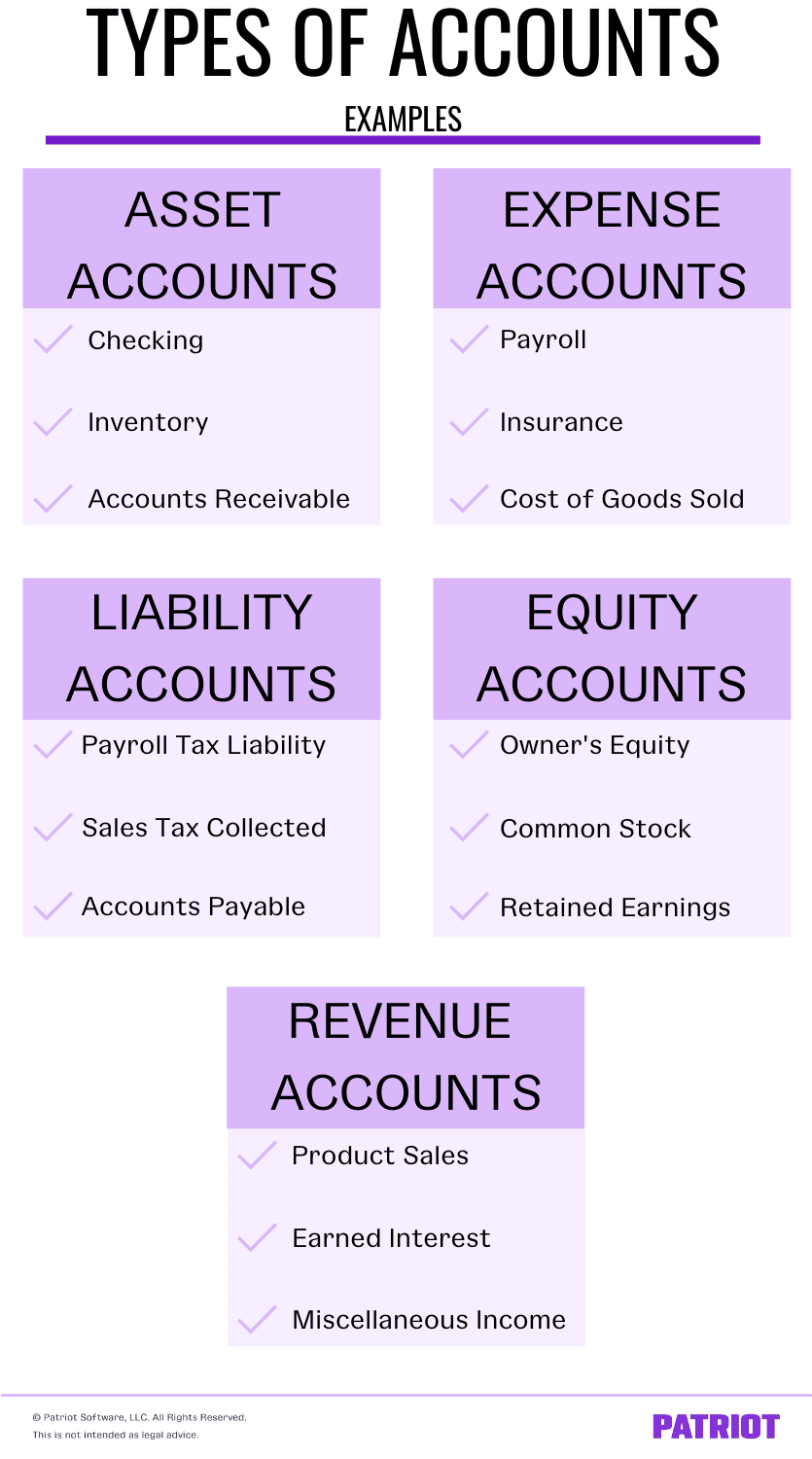

That doesn’t mean recording every single detail about every single transaction. You don’t need a separate account for every product you sell, and you don’t need a separate account for each utility. COAs are typically made up of five main accounts, with each having multiple subaccounts. Most QuickBooks Online plans, for example, support up to 250 accounts.

In short, it is an organizational tool that lists by category and line item all of the financial transactions that a company conducted during a specific accounting period. The accounts in the list provide the basic structure for an organization’s financial statements and GL. They are customized to provide the information required for needed visibility, reporting, and compliance. Frequent changes to the numbering structure are not generallyencouraged as they can cause confusion, especially if not executed on a regular schedule, such as on an annual basis only. A COA is designed to provide a view of an organization’s financial situation and health, using a delineated means to separate assets, liabilities, revenue, and expenditures. It assists with management reporting and is critical for meeting the demands of regulatory compliance.

If you keep your COA format the same over time, it will be easier to compare results through several years’ worth of information. This acts as a company financial health report that is useful not only to business owner, but also investors and shareholders. Accounts receivable, aka AR, represents the balance of money due to a firm for delivered but unpaid goods or services delivered to the customer. To better understand this, consider your personal financial statement. You regularly use your checking account for your day-to-day expenses. A chart of accounts (COA) is a financial, organizational tool that provides an index of every account in an accounting system.

For example, if you rent, the money will move from your cash account to a rent expense account. Every time you add or remove an account from your business, it’s important to record it in your books and your how to do a competitive analysis in 2021 chart of accounts (COA) helps you do that. While some countries define standard national charts of accounts (for example France and Germany) others such as the United States and United Kingdom do not.

Liabilities may often have a “payable”descriptor (i.e., AP) attached to them. The balance sheet provides an overview of assets,liabilities, and stockholders’ equity at a specific pointin time. An organization’s financial statements are thoserecords that convey all its related business transactions,wellbeing and status, and the overall financialperformance of the entity. Each account is assigned a “type” that identifies how a transaction is to be coded, indicating where it should appear in the financial statement. Most software applications offer a multitude of options and categories for the account type and having these set up accurately is critical to financial statement accuracy. COA stands for chart of accounts, which is a systematic arrangement of all the account titles and numbers a business uses for its accounting system.

Expense accounts allow you to keep track of money that you no longer have. Now, the trial balance (the summary of all account balances) checking account balance reflects $125,453 at the end of May which is included in the financial statements. There are many different ways to structure a chart of accounts, but the important thing to remember is that simplicity is key. The more accounts are added to the chart and the more complex the numbering system is, the more difficult it will be to keep track of them and actually use the accounting system. A well-designed chart of accounts should separate out all the company’s most important accounts, and make it easy to figure out which transactions get recorded in which account. Expense accounts allow you to keep track of money that you no longer have, and represents any money that you’ve spent.

The first digit might, for example, signify the type of account (asset, liability, etc.). In accounting software, using the account number may be a more rapid way to post to an account, and allows accounts to be presented in numeric order rather than alphabetic order. Because the chart of accounts is a list of every account found in the business’s accounting system, it can provide insight into all of the different financial transactions that take place within the company. It helps to categorize all transactions, working as a simple, at-a-glance reference point. Similar to a chart of accounts, an accounting template can give you a clear picture of your business’s financial information at a glance. Utilizing accounting tools like these will ensure a better workflow, helping you grow your company.