Accounts payable (AP) turnover ratio and creditors turnover ratio are essentially the same, albeit expressed differently. Both these ratios measure the speed with which a business pays off its suppliers. A decline in the AP turnover ratio may also be related to more favorable credit terms from suppliers. In some instances, a business can negotiate payment terms that allow the business to extend the period of time before invoices are paid. Since a company’s accounts payable balances must be paid in 12 months or less, they are categorized as a current liability in the financial statements like the balance sheet. Accounts payable turnover ratio, or AP turnover ratio, is a measure of how many times a company pays off AP during a period.

How Can SaaS Companies Find the Right Balance?

We don’t think that this approach is comprehensive enough to get a handle on cash flow. Therefore, we suggest using all credit purchases in the formula, not just inventory and cost of sales that focus on inventory turnover. The accounts payable what you can and cant write off with business travel turnover ratio, or AP turnover, shows the rate at which a business pays its creditors during a specified accounting period. This KPI can indicate a company’s ability to manage cash flow well and then pay off its accounts in a timely manner.

Increase your cash flow

By renegotiating payment terms with your vendors, you can improve the length of time you have to pay, and can improve relationships by paying on time. Because the turnover of payables is unique to each business type, you’ll gain the most valuable information for your investment analysis by comparing companies within the same industry. You should be aware, however, that an acceptable result for the payable turnover ratio varies from industry to industry. Additionally, the technology industry can benefit from a high Accounts Payable Turnover Ratio.

- AP turnover shows how often a business pays off its accounts within a certain time period.

- By renegotiating payment terms with your vendors, you can improve the length of time you have to pay, and can improve relationships by paying on time.

- Your AP aging report helps you see the status of your unpaid invoices and outstanding payments.

- A company with a low ratio for AP turnover may be in financial distress, having trouble paying bills and other short-term debts on time.

Monitor AP Turnover in Real Time with Mosaic

Your company’s accounts payable software can automatically generate reports with total credit purchases for all suppliers during your selected period of time. If it’s not automated, you can create either standard or custom reports on demand. The trade payables and accounts payable turnover ratios are basically the same concept referred to using different terminologies. Both metrics assess how quickly a business settles its obligations to its suppliers.

How Technology can Help Improve Accounts Payable Turnover Ratio

Check out an interactive demo environment to see what Ramp’s financial reporting features can tell you about your business. Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations. Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies. She is a former CFO for fast-growing tech companies with Deloitte audit experience. When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg.

How do you convert the AP turnover ratio to number of days outstanding in accounts payable?

Finding the right balance between high and low accounts payable turnover ratios is important for a financially stable business that invests in growth opportunities. A higher ratio satisfies lenders and creditors and highlights your creditworthiness, which is critical if your business is dependent on lines of credit to operate. But, investors may also seek evidence that the company knows how to use investments strategically. In that case, a business may take longer to pay off bills while it uses funds to benefit the business. The accounts payable turnover ratio shows investors how many times per period a company pays its accounts payable. In other words, the ratio measures the speed at which a company pays its suppliers.

The accounts payable (AP) turnover ratio measures how quickly a business pays its total supplier purchases. So, it’s time to upgrade if you don’t use accounting software like QuickBooks Online. It allows you to keep track of all of your income and expenses for your business. You can also run several reports that will help you not only calculate your A/P and A/R turnover ratios but also analyze cash flow and profitability.

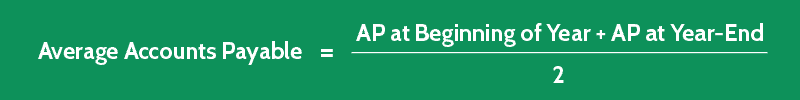

You can calculate your AP turnover ratio by dividing net credit purchases by your average AP balance. Drawbacks to the AP turnover ratio relate to the interpretation of its meaning. How does the accounts payable turnover ratio relate to optimizing cash flow management, external financing, and pursuing justified growth opportunities requiring cash?