When employing the LIFO perpetual inventory system, calculating the Cost of Goods Sold (COGS) requires a methodical approach, as it demands frequent updates. As each inventory transaction occurs, businesses must ensure that the most recent purchase costs are allocated to the goods sold. This process is essential for accurately determining the COGS, which impacts gross profit and net income figures on financial statements. The Weighted Average Cost (WAC) is the cost flow assumption businesses use to value their inventory. Also called the moving average cost method, accountants perform this differently in a perpetual system as compared to a periodic system.

Gross Profit Method

Once the value of ending inventory is found, the calculation of cost of sales and gross profit is pretty straight forward. The first step is to note the additions in inventory in the left column, along with the purchase cost for each day. For example, on the first day, 10 units of inventory were added at the cost of $500 each, which we will record as follows. LIFO is banned under the International Financial Reporting Standards that are used by most of the world because it minimizes taxable income.

What Is the Weighted Average Cost Perpetual Inventory Method?

The Last-In, First-Out (LIFO) perpetual inventory system prioritizes the most recently acquired inventory items for cost allocation. This approach is beneficial in times of rising prices, as it aligns the cost of goods sold with current market conditions, potentially leading to a more accurate reflection of a company’s financial performance. By consistently applying this method, businesses can manage their inventory costs and maintain a competitive edge. Perpetual inventory and periodic inventory are both accounting methods used by businesses to track the number of products they have available.

What Is the Difference Between Perpetual and Periodic Inventory Systems?

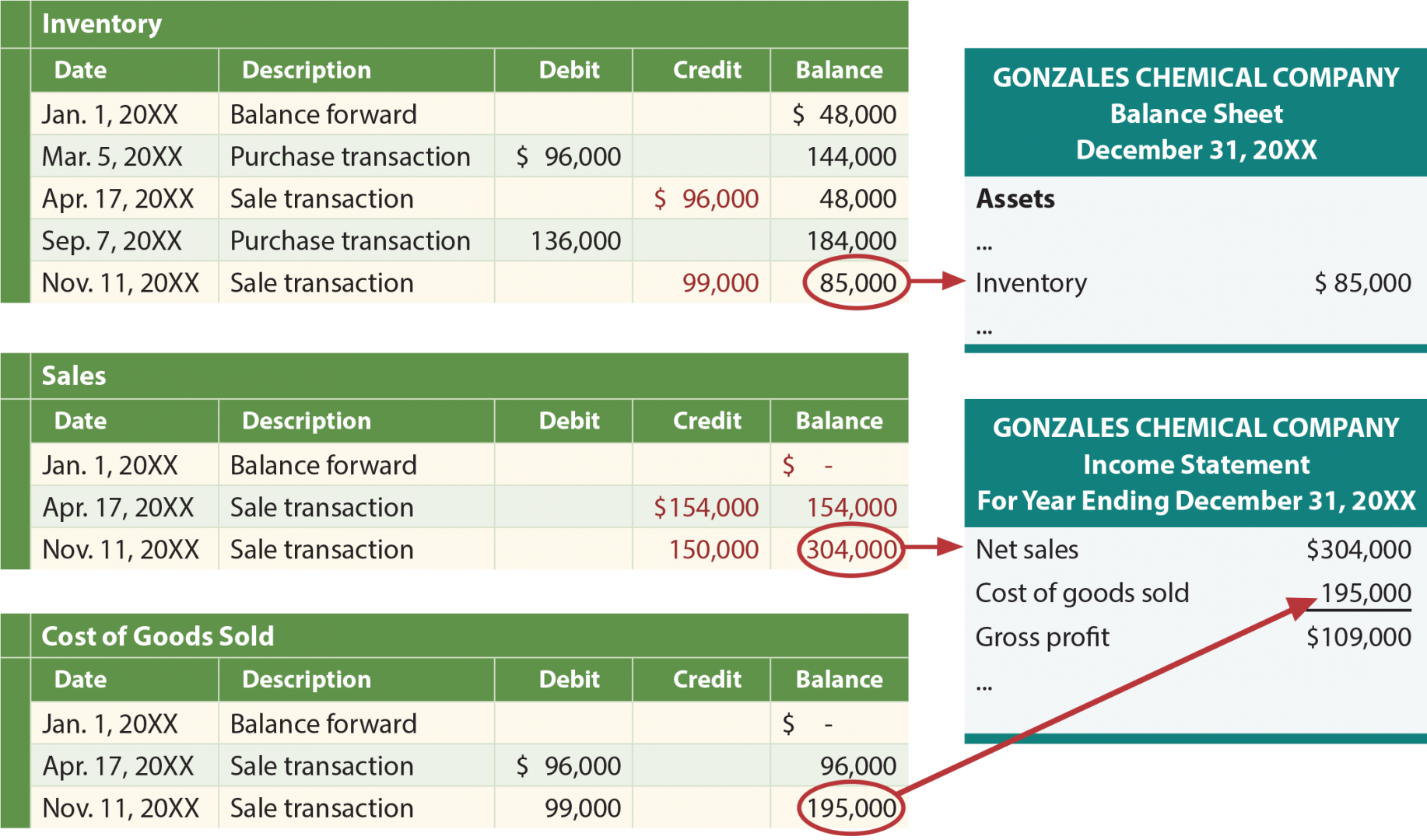

In these cases, inventories are small enough that they are easy to manage using manual counts. Changes in inventory are accurate (as long as there is no theft or damage to any goods) and can be easily accessed immediately. The cost of goods sold (COGS) account is also updated continuously as each sale is made.

We serve the needs of affordable housing, construction, family-owned businesses, healthcare, manufacturing and distribution, and nonprofit industries. We also assist service organizations with the full suite of SOC services (including SOC 2 reports), HiTrust CSF, internal audits, SOX compliance, and employee benefit plan audits. Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services.

- LIFO perpetual inventory is an accounting method that affects how businesses track and value their inventory.

- When calculating inventory and Cost of Goods Sold using LIFO, you use the price of the newest goods in your calculations.

- All four of the listed methodologies offer distinct benefits, making it important for management to assess which option aligns best with the strategic direction of their company.

- Unlike periodic systems, which update inventory at specific intervals, the perpetual system records each transaction as it occurs.

A perpetual inventory system continuously updates stock levels as transactions occur. This real-time tracking provides accurate information on current inventory levels and quantities at any given time. On the other hand, a periodic inventory system only updates stock levels at scheduled intervals, typically at month-end or year-end when physical counts are conducted. This can lead to discrepancies between actual and recorded inventories due to theft, damage, or errors.

Then, the company can also compute the cost of goods available for sale for the new period. Perpetual inventory is a continuous accounting practice that records inventory changes in real-time, without the need for physical inventory, so the book inventory accurately shows the real stock. Warehouses register perpetual inventory using input devices such as point of sale (POS) systems and scanners. Under the perpetual inventory system, we determine the COGS and inventory after every sale instead of waiting until the end of the year. This requires much more work and is only recommended if you use inventory management software that can integrate with your accounting software. InFlow is an inventory management software that can use LIFO and integrate with popular accounting software like QuickBooks Online and Xero.

Note that this $21 is different than the gross profit of $20 under periodic LIFO. Based on the LIFO method, the last inventory in is the first inventory sold. In total, the cost of the widgets under the LIFO method is $1,200, or five at $200 and two at $100. But the cost of the widgets is based on the inventory method selected. Most companies that use LIFO inventory valuations need to maintain large inventories, such as retailers and auto dealerships.

She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn. LIFO, or Last In, First Out, is an inventory value method that assumes that the goods bought most recently are the first to be sold.

This section will explore the advantages and disadvantages of employing a perpetual inventory system for your business. Assume our physical inventory count reveals 80 units in ending inventory. Hence, the cost of ending inventory is $192, composed of four units in beginning inventory (4 units x $38 each) and one unit from purchases (1 x $40 each).

Well, that would be the physical flow, but that doesn’t matter with the accounting records, we don’t have to match that actual can with the cost of that actual can itself, right? We’re going to use these methods to help simplify the process, and it doesn’t have to align how to figure out which irs payment plan is best for you with which actual can we sold and what we paid for that can. FIFO, LIFO, and average cost, we just look at it kind of in the big picture, alright? So let’s go ahead and pause here and then we will start an example of how to use these methods in a perpetual system.